Introduction

‘Where your money goes’ outlines important information about your council tax (and business rates) and how your money is used to deliver services in South Gloucestershire for the benefit of all residents.

South Gloucestershire Council will spend more than £287 million on day-to-day services and invest more than £132 million on capital projects and infrastructure schemes, like building new schools and maintaining our roads, in the coming year.

Balancing the budget has been a challenge due to the impact of the cost-of-living crisis, which means the council needs to pay more to deliver services, while demand for those services continues to grow.

The council has been able to rise to those challenges. Council tax will rise to help meet increasing costs, but this is being kept below inflation.

The most vital frontline services that local people rely upon have been protected and we have set aside more money to help those who are also facing rising costs and to invest in priorities important to local communities.

Council tax and your bill

Council tax helps pay for local services such as police and fire, schools, roads, street lights, libraries, waste and recycling collection.

The amount of council tax you pay is based on the valuation band of your property and any discounts or exemptions that you may be entitled to.

In 2022/23 the council increased council tax by 3.99% and now in 2023/24 needs to increase its share by 4.99%, including a 2% increase for adult social care.

This is primarily due to the increasing demand for services, particularly for adult and children’s social care.

The South Gloucestershire Council element of the council tax for a band D property for 2023/24 is £1,752.11, an increase of £83.27.

How your £1,752.11 is broken down to pay for the services we provide

Supporting vulnerable adults

£788.16

Supporting vulnerable children

£302.36

Education and skills – council funded

£75.17

Roads, parks, transport and the environment

£110.75

Waste and recycling

�£116.17

Libraries and safe communities

£43.16

Public health

£5.23

Other services, support services and levies

£311.11

With precepts added from the Police and Crime Commissioner, Avon Fire Authority and all 50 parishes, the average 2023/24 total council tax for a band D property is £2,191.31.

Council tax support fund

If you are currently a working age or pension age Local Council Tax Support customer, you may benefit from a further reduction in your 2023/24 bill by up to £25.

This will be shown on the face of your bill with the reference Council Tax Support Fund 2023 and no action is required.

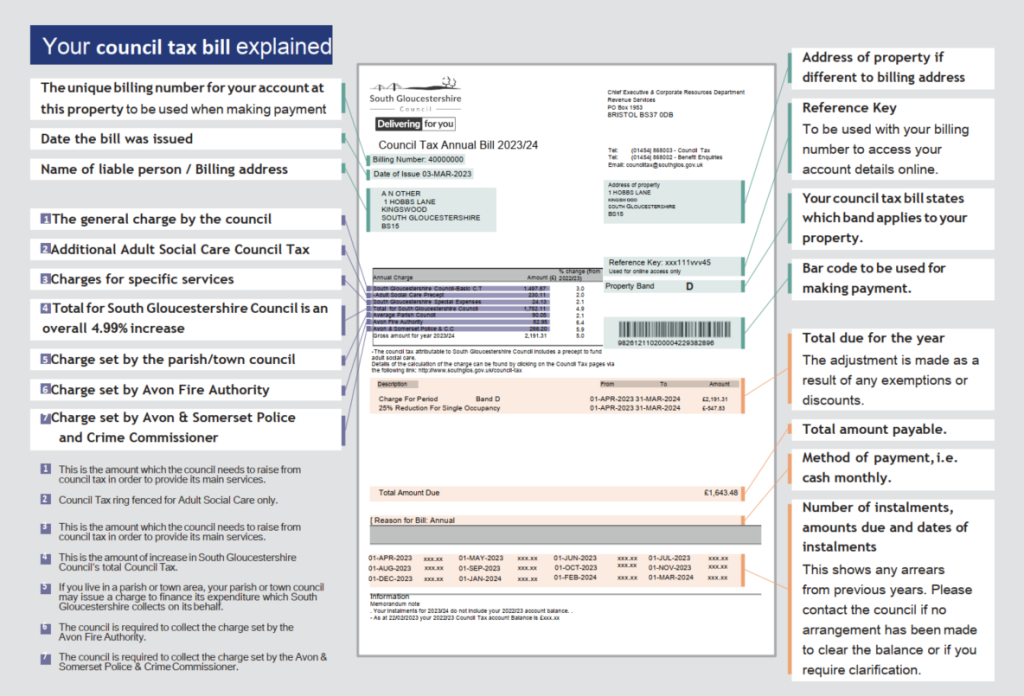

Your council tax bill explained

Download the above bill example (pdf)

Paying your council tax

There are several ways you can pay your council tax, find out more on our pay your council tax page.

Contact us as soon as possible to get help if you are struggling to pay.

Council tax reduction and housing benefit enquiries

Council tax reduction is a scheme to help those on a low income to get help to pay their council tax.

If you need help with council tax reduction or housing benefit you can call 01454 868002 or visit one of our One Stop Shops.

Discounts and exemptions

In some circumstances you may be entitled to a discount or exemption. Find out more on our discounts and exemptions page.

Viewing your details online and electronic billing

You will need your reference key and billing number from your latest bill to view your details online. These can be found on the front of your bill.

You will be able to view account details (including payments made), set up or amend direct debits, ask for an e-bill rather than a printed copy and update your contact details.

To set this up visit the manage your council tax online page.

Reporting changes in your circumstances

Important

It is your responsibility to tell us immediately about any changes that may affect the amount of housing benefit, council tax exemption, discount, or reduction you get.

You are committing an offence if you deliberately fail to tell us about a change in your circumstances.

Appeals

There are two areas for appeal.

Against the valuation band (area 1)

These appeals should be made to the Valuation Office using the following link check your council tax band – GOV.UK

Against your council tax charge (area 2)

These appeals should be made in writing to the council tax section, at South Gloucestershire Council.

You can appeal if you think you are not liable to pay council tax because:

- you are not the owner or the resident

- your property is exempt

- you think there has been a mistake in the way your bill has been calculated

You still need to pay your council tax whilst waiting for the appeal decision.

Precepts (payment for essential services)

Your council tax bill also collects precepts for adult social care, the police, fire services, town and parish councils, and special expenses.

Adult social care precept

The adult social care precept allows councils who provide social care to adults to charge an additional amount for council tax.

The precept is not linked to whether or not taxpayers receive social care services. If you already pay for care services, the precept does not replace these charges.

It is a government requirement that this charge is shown as a separate line on the bill.

Emergency services

In 2023/24 Avon and Somerset Police and Crime Commissioner charges have increased by 5.97% (or £15.00 on an average band D property).

Avon Fire Authority charges have increased by 6.41% (or £5.00 on an average band D property).

You can read more about these charges:

- Avon and Somerset Police and Crime Commissioner council tax leaflet

- Avon Fire Authority council tax leaflet

Town and parish councils

From 2023/24 following the recent Community Governance Review. There are now 50 town and parish councils in South Gloucestershire, with all areas now parished.

Town and parish councils set their budgets independently, with the exception for the new parish councils which have been set by South Gloucestershire Council for their first year only, and while the average increase for 2023/24 is 2.14%, the charges range from -7.1% to +30.8%

Special expenses

The cost of the council’s services is spread mainly uniformly over the authority’s area.

In some areas, the town or parish council may provide services which are the responsibility of South Gloucestershire Council in others. These are called special expenses.

Special expenses are only charged to the areas which directly benefit from them. They vary across the 50 parished areas.

Business rates (or non-domestic rates)

Business rates (or non-domestic rates) are taxes paid on non domestic properties to help towards the cost of local council services.

Business rates retention arrangements allow authorities to keep a proportion of the local business rates. This helps pay for the services provided by the local authority in your area.

For more information about business rates visit our business rates section and the about business rates or non-domestic rates page on our website.

GOV.UK also has information about the business rates system.

The council’s budget

For 2023/24, the council is increasing its share of the general council tax by 2.99% and 2% for adult social care, in line with government limits.

The 2023/24 budget also includes updated details of the council’s savings programmes.

The current savings programme is planned to deliver £40m by 2026/27, leaving a relatively small budget shortfall in 2026/27.

The council will obtain it’s funding for 2023/24 from the following sources:

- 46% from government funding and grants

- 21% will come from council taxpayers (including the 2.99% council tax increase ring fenced for adult social care)

- 21% from sales, fees and charges

- 9% from business rate payers

- 3% from reserves

The council will spend the funding on the following service areas:

- 34% is spent on schools

- 21% on services supporting vulnerable adults

- 12% on other services, support services and levies

- 10% on services supporting vulnerable children and council funded education and skills

- 10% on services supporting transport, environment and community services

- 7% for waste services

- 5% supporting housing benefit

- 1% supporting public health

Further information

The following CSV files are available for further information on:

- council services and how they are funded

- capital expenditure

- council tax to be collected and payments due

- town and parish councils spending more than £140,000

- other levies on the council

Contact us

If you need any further advice or you are unable to print this document and require a hard copy you can:

- call 01454 868003

- email counciltax@southglos.gov.uk