Page contents

- Introduction

- Council tax and your bill

- Precepts (payment for essential services)

- Business rates (or non-domestic rates)

- The council’s budget

- Council services and how they are funded

- Why the budget has changed

- Capital investment

- Council tax to be collected and payments due

- Town and parish councils spending more than £140,000

- Other levies on the council

Introduction

‘Where your money goes’ outlines important information about your council tax (and business rates) and how your money is used to deliver services in South Gloucestershire for the benefit of all residents.

South Gloucestershire Council will invest £400 million in services and capital, such as building new schools, in the 2022/23 financial year. We are pleased to have agreed a balanced budget whilst also limiting the annual council tax rise to well below inflation through prudent financial management.

Supporting our most vulnerable residents is at the core of this budget, while improving our communities for everyone. We are also supporting those who feel the financial impact of the Covid-19 pandemic, with our Community Resilience Fund and we are helping people to live healthier lives through our £1million Prevention Fund.

We are investing in the future too, with more than £12 million on maintenance and improvements to roads, including funding to tackle potholes which will benefit drivers and cyclists alike. An extra £639,000 is being invested in street cleaning to expand the successful team, ensuring our communities are clean and attractive places to live and work.

Protecting our future is also critical to the success of not just South Gloucestershire but to everyone, which is why we are taking direct action to respond to the climate and nature emergencies from improving biodiversity in our district to supporting The Wave’s plans to go off-grid.

Ensuring all children have the best start in life is another key priority, with investment to build new and enhance existing schools, increasing support for children with special educational needs, and expanding and improving our social care support.

There is also plenty to celebrate this year with the Queen’s Jubilee in June, which we will mark by opening a new biodiversity park in Cadbury Heath and supporting a number of community events, and we look forward to welcoming the Tour of Britain to South Gloucestershire in September.

Councillor Toby Savage, Leader of the Council

Council tax and your bill

Council tax helps pay for local services such as police and fire, schools, roads, street lights, libraries, waste and recycling collection.

The amount of council tax you pay is based on the valuation band of your property and any discounts or exemptions that you may be entitled to.

In 2021/22 the council increased council tax by 4.99% and now in 2022/23 needs to increase its share by 2.99%, including a 1% increase for adult social care.

This is primarily due to the increasing demand for services, particularly for adult and children’s social care.

The South Gloucestershire Council element of the council tax for a band D property for 2022/23 is £1,668.84, an increase of £48.45.

With precepts added from the Police and Crime Commissioner, Avon Fire Authority and all 47 parishes, the average 2022/23 total council tax for a band D property is

£2,086.15.

£150 government council tax rebate

If you live in a property in council tax bands A to D, you are likely to receive a £150 council tax rebate from the government to help with the cost of living.

Read more on GOV.UK Council tax energy rebate: information leaflet for households in council tax bands A-D

Your council tax bill explained

Download the above bill example (PDF)

Paying your council tax

There are several ways you can pay your council tax, find out more on our paying your council tax webpage.

If you have any problems paying your council tax bill contact us as soon as possible.

Council tax reduction and housing benefit enquiries

Local council tax reduction is a scheme to help those on a low income to get help to pay their council tax.

If you need help with council tax reduction or housing benefit you can call 01454 868002 or visit one of our one stop shops.

Discounts and exemptions

In some circumstances you may be entitled to a discount or exemption. Find out more on our discounts and exemptions webpage.

Viewing your details online

You will need your reference key and billing number from your latest bill to view your details online. These can be found on the front of your bill.

You will be able to view account details (including payments made), set up or amend direct debits, ask for an e-bill rather than a printed copy and update your contact details.

To set this up visit the my council tax online webpage.

Electronic billing

You can now have your council tax bill sent by email.

This can be arranged through your online account or by contacting us:

- call the council tax team 01454 868003

- email counciltax@southglos.gov.uk

Reporting changes in your circumstances

Important

It is your responsibility to tell us immediately about any changes that may affect the amount of housing benefit, council tax exemption, discount, or reduction you get.

You are committing an offence if you deliberately fail to tell us about a change in your circumstances.

Appeals

There are two areas for appeal.

Against the valuation band (area 1)

These appeals should be made in writing to the Council Tax section, at South Gloucestershire Council. You still need to pay your council tax whilst waiting for the appeal decision.

Against your council tax charge (area 2)

You can appeal if you think you are not liable to pay council tax because:

- you are not the owner or the resident

- your property is exempt

- you think there has been a mistake in the way your bill has been calculated

Precepts (payment for essential services)

Your council tax bill also collects precepts for adult social care, the police, fire services, town and parish councils, and special expenses.

Adult social care precept

The adult social care precept allows councils who provide social care to adults to charge an additional amount for council tax.

The precept is not linked to whether or not taxpayers receive social care services. If you already pay for care services, the precept does not replace these charges.

It is a government requirement that this charge is shown as a separate line on the bill.

Emergency services

In 2022/23 Avon and Somerset Police and Crime Commissioner charges have increased by 4.15% (or £10.00 on an average B and D property).

Avon Fire Authority charges have increased by 1.99%.

You can read more about these charges:

- Avon and Somerset Police and Crime Commissioner council tax leaflet

- Avon Fire Authority council tax leaflet

Town and parish councils

There are 47 town and parish councils in South Gloucestershire, not all areas have one.

Town and parish councils set their budgets independently, and while the average increase for 2022/23 is 4.47%, the charges range from -41.4% to 79.5%

Special expenses

The cost of the council’s services is spread mainly uniformly over the authority’s area.

In some areas, the town or parish council may provide services which are the responsibility of South Gloucestershire Council in others. These are called special expenses.

Special expenses are only charged to the areas which directly benefit from them. They vary across the 47 parished and the unparished areas.

Business rates (or non-domestic rates)

Business rates (or non-domestic rates) are taxes paid on non domestic properties to help towards the cost of local council services.

Business rates retention arrangements allow authorities to keep a proportion of the local business rates. This helps pay for the services provided by the local authority in your area.

For more information about business rates visit our business rates section and the about business rates or non-domestic rates page on our website.

GOV.UK also has information about the business rates system.

The council’s budget

The council increased its share of the council tax by 1.99% in 2021/22 for the general council tax precept with a 3% increase for adult social care.

For 2022/23, the council is increasing its share of the general council tax by 1.99% and 1% for adult social care, in line with government limits.

The 2022/23 Budget also includes updated details of the council’s savings programmes.

The current savings programme is planned to deliver £23.565m from 2022/23 to 2025/26, leaving a balanced budget thereafter.

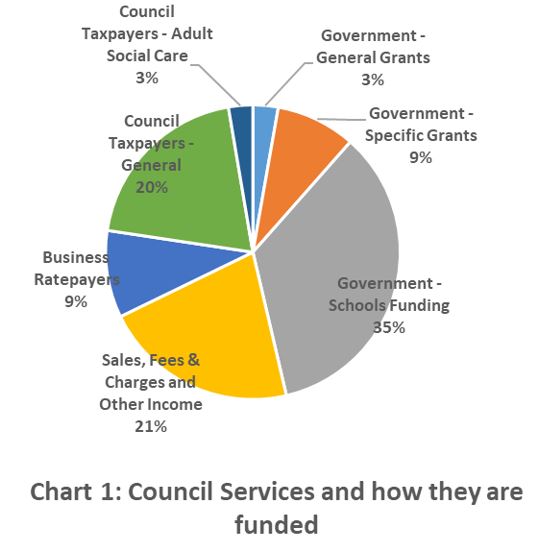

The first pie chart below shows where the council will obtain its funding for 2022/23:

- 23% will come from council taxpayers (of which 3% is ring fenced for adult social care)

- 9% from business rate payers

- 47% from government funding and grants

- 21% from sales, fees and charges

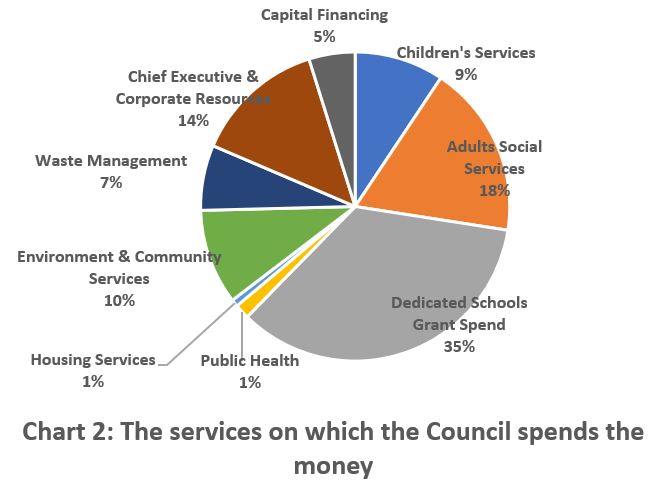

The second pie chart below shows the services on which the council spends money:

- 35% is spent on schools

- 28% on services for young people, and for the elderly and those with disabilities and public health

- 19% for Chief Executive and Corporate Resources, and capital financing

- 11% being spent on transport, environment and community services

- 7% for waste services

Plans for the next 10 years

In addition to setting its budget and council tax for 2022/23, the council has also looked at the next 10 years’ plans.

The government had previously announced its intention to change the way all councils are to be financed through the business rates retention system.

This has been delayed for another year as result of the pandemic and it is now anticipated that this will come into effect from 2023/24.

Significant work and engagement with local government has already been undertaken by central government and will continue over the next financial year. Alongside some other devolution areas, the councils in the West of England Combined Authority area (which includes this council) previously entered into a pilot for 100% rates retention from 1 April 2018 and the council continues to benefit from this in 2022/23.

The council expects that further investment will be needed in services for the over 65s and for vulnerable young people over the next few years.

In order to achieve a balanced budget in the medium term, the council needs to achieve the savings identified in its budget proposals amounting to £23.565m.

Council services and how they are funded

The following tables show the council’s revenue budget for last year and the current year plus indicative budgets for the next 3 years.

They also show the causes of the change in net spending and the capital investment being made by the council in its buildings, roads and other facilities.

CAH – Children, Adults and Health

ECS – Environment and Community Services

CECR – Chief Executive and Corporate Resources

| Expenditure | 2021/ 2022 Net £m | 2022/ 2023 Gross Exp £m | 2022/ 2023 Income £m | 2022/ 2023 Reserves £m | 2022/ 2023 Net £m |

| Schools | 0.0 | 262.9 | -257.9 | -4.9 | 0.0 |

| CAH | 149.1 | 221.4 | -50.5 | -3.0 | 167.9 |

| ECS | 42.1 | 126.7 | -77.3 | -6.7 | 42.7 |

| CECR | 21.4 | 103.6 | -78.4 | -1.9 | 23.3 |

| Other services including capital financing | 38.3 | 39.2 | -17.4 | 3.8 | 25.6 |

| Total expenditure | 251.0 | 753.7 | -481.5 | -12.7 | 259.5 |

| Funding | |||||

| Government – general grants | -23.0 | -20.5 | -20.5 | ||

| Government – schools funding | -63.2 | -257.5 | -257.5 | ||

| Government – specific grants | -250.5 | -65.5 | -65.5 | ||

| Sales, fees charges and other income | –153.7 | -172.2 | –172.2 | ||

| Business ratepayers | -64.8 | -70.7 | -70.7 | ||

| Council taxpayers | -141.2 | -147.6 | -147.6 | ||

| Council taxpayers – Adult social care | -17.7 | -19.7 | -19.7 | ||

| Total funding | -714.1 | -753.7 | -753.7 |

Download the above table as a csv file.

Why the budget has changed

| Net revenue budget 2021/22 | 250,982 |

| Inflation | 7,963 |

| Demographic growth | 9,635 |

| Service investment | 4,872 |

| Service demand increases | 1,371 |

| Council savings | -6,560 |

| Temporary grant changes (e.g. change in Covid-19 grants) | -7,673 |

| Other (including capital financing) | -1,084 |

| Net revenue budget 2022/23 | 259,506 |

| Total increase (+) / decrease (-) | 8,524 |

Download the above table as a csv file.

Capital investment

| 2022/ 2023 £m | 2023/ 2024 £m | 2024/ 2025 £m | 2025/ 2026 £m | |

| Children, Adults and Health | 47 | 13 | 5 | 8 |

| Environment and Community Services | 43 | 26 | 17 | 16 |

| Economic development fund schemes | 31 | 8 | 10 | 0 |

| Other services and Invest to Save | 19 | 10 | 4 | 2 |

| Total | 140 | 57 | 36 | 26 |

Download the above table as a csv file.

Council tax to be collected and payments due

| 2021/22 | 2021/22 | 20/22/23 | 2022/23 | |

| Precept £ | Payments Band D £ | Precept £ | Payments Band D £ | |

| 158,869,169 – 2,047,306 | 1,620.39 – 20.6 | South Gloucestershire tax requirement Less special expenses reallocated | 167,122,280 – 2,121,355 | 1,668.84 – 21.18 |

| 156,821,863 | 1,599.79 | 165,000,925 | 1,647.66 | |

| 7,493,503 | 76.43 | Avon Fire Authority | 7,806,147 | 77.95 |

| 23,648,213 | 241.20 | Avon and Somerset Police and Crime Commissioner | 25,155,922 | 251.20 |

Download the above table as a csv file.

Council Tax By Area (including parish precepts and special expenses)

| 2022/23 | 2022/23 | 2022/23 | |

| Precept | Special expenses | Payments Band D | |

| Total Unparished Areas | £386,748.00 | £2,007.89 | |

| Acton Turville | £5,579.00 | £429.00 | £2,014.36 |

| Almondsbury | £267,417.00 | £4,657.00 | £2,096.24 |

| Alveston | £60,296.00 | £6,255.00 | £2,025.89 |

| Aust | £5,990.00 | £45.00 | £2,002.93 |

| Bitton | £121,632.00 | £79,365.00 | £2,036.68 |

| Bradley Stoke | £810,862.00 | £136,815.00 | £2,113.48 |

| Charfield | £62,000.00 | £30,029.00 | £2,054.34 |

| Cold Ashton | £4,400.00 | £0.00 | £2,010.40 |

| Cromhall | £22,330.00 | £334.00 | £2,047.41 |

| Dodington | £299,245.00 | £120,216.00 | £2,153.50 |

| Downend and Bromley Heath | £304,500.00 | £87,271.00 | £2,061.70 |

| Doynton | £5,250.00 | £0.00 | £2,009.62 |

| Dyrham and Hinton | £9,200.00 | £778.00 | £2,045.15 |

| Emersons Green | £269,073.00 | £131,862.00 | £2,036.40 |

| Falfield | £7,580.00 | £643.00 | £2,002.91 |

| Filton | £986,694.00 | £26,373.00 | £2,299.85 |

| Frampton Cotterell | £354,700.00 | £32,011.00 | £2,124.87 |

| Great Badminton | £2,685.00 | £0.00 | £2,002.63 |

| Hanham | £54,531.00 | £73,915.00 | £2,036.28 |

| Hanham Abbots | £70,070.00 | £60,609.00 | £2,032.05 |

| Hawkesbury | £23,597.00 | £4,031.00 | £2,028.45 |

| Hill | £500.00 | £0.00 | £1,986.43 |

| Horton | £6,500.00 | £2,646.00 | £2,025.99 |

| Iron Acton | £57,758.00 | £845.00 | £2,072.41 |

| Little Sodbury | £520.00 | £0.00 | £1,985.93 |

| Marshfield | £66,545.00 | £10,861.00 | £2,079.74 |

| Oldbury on Severn | £17,595.00 | £91.00 | £2,024.61 |

| Oldland | £184,717.00 | £183,772.00 | £2,052.06 |

| Olveston | £68,750.00 | £4,767.00 | £2,058.58 |

| Patchway | £816,643.00 | £53,472.00 | £2,183.83 |

| Pilning and Severn Beach | £74,670.00 | £39,415.00 | £2,071.96 |

| Pucklechurch | £87,026.00 | £22,154.00 | £2,090.07 |

| Rangeworthy | £13,000.00 | £1,318.00 | £2,021.42 |

| Rockhampton | £3,315.00 | £335.00 | £2,019.75 |

| Siston | £40,000.00 | £98,731.00 | £2,062.66 |

| Sodbury | £282,414.00 | £45,584.00 | £2,130.73 |

| Stoke Gifford | £465,000.00 | £96,191.00 | £2,068.06 |

| Stoke Lodge and The Common | £61,346.00 | £9,961.00 | £2,076.26 |

| Thornbury | £835,313.00 | £92,576.00 | £2,146.41 |

| Tormarton | £7,500.00 | £445.00 | £2,022.47 |

| Tortworth | £200.00 | £0.00 | £1,980.20 |

| Tytherington | £34,350.00 | £3,254.00 | £2,072.74 |

| Westerleigh | £92,438.00 | £7,033.00 | £2,039.73 |

| Wick and Abson | £85,000.00 | £2,432.00 | £2,093.54 |

| Wickwar | £54,960.00 | £12,473.00 | £2,049.79 |

| Winterbourne | £185,350.00 | £29,642.00 | £2,032.20 |

| Yate | £1,539,994.00 | £220,971.00 | £2,195.54 |

Download the above table as a csv file.

The total council tax required by the 47 Parish and Town Councils amounts to £8,273,659.

Town and parish councils spending more than £140,000

| Net expenditure (£) | Net expenditure (£) | |

| 2021/22 | Almondsbury Parish Council | 2022/23 |

| 124,734 | Recreation | 164,350 |

| 100,000 | Capital projects | 68,000 |

| 162,700 | Other services | 177,627 |

| 0 | Contingencies | 0 |

| 387,434 | 409,977 | |

| -238,661 | Balance Transfer | -142,560 |

| 148,773 | TOTAL | 267,417 |

| Net expenditure (£) | Net expenditure (£) | |

| 2021/22 | Bradley Stoke Town Council | 2022/23 |

| 589,020 | Recreation | 670,923 |

| 199,500 | Capital projects | 242,910 |

| 1,102,402 | Other services | 1,225,667 |

| 18,500 | Contingencies | 17,500 |

| 1,909,422 | 2,157,000 | |

| -1,097,741 | Balance Transfer | -1,346,138 |

| 811,681 | TOTAL | 810,862 |

| Net expenditure (£) | Net expenditure (£) | |

| 2021/22 | Dodington Parish Council | 2022/23 |

| 98,500 | Recreation | 98,500 |

| 0 | Capital projects | 0 |

| 176,600 | Other services | 195,745 |

| 4,900 | Contingencies | 5,000 |

| 280,000 | 299,245 | |

| 0 | Balance Transfer | 0 |

| 280,000 | TOTAL | 299,245 |

| Net expenditure (£) | Net expenditure (£) | |

| 2021/22 | Downend and Bromley Heath Parish Council | 2022/23 |

| 619,718 | Recreation | 775,068 |

| 91,703 | Capital projects | 91,703 |

| 199,463 | Other services | 385,351 |

| 0 | Contingencies | 0 |

| 910,884 | 1,252,122 | |

| -606,384 | Balance Transfer | -947,622 |

| 304,500 | TOTAL | 304,500 |

| Net expenditure (£) | Net expenditure (£) | |

| 2021/22 | Emersons Green Town Council | 2022/23 |

| 25,214 | Recreation | 38,000 |

| 0 | Capital projects | 0 |

| 210,989 | Other services | 192,065 |

| 0 | Contingencies | 0 |

| 236,203 | 230,065 | |

| 20,029 | Balance Transfer | 62,158 |

| 256,232 | TOTAL | 292,223 |

| Net expenditure (£) | Net expenditure (£) | |

| 2021/22 | Filton Town Council | 2022/23 |

| 535,818 | Recreation | 436,711 |

| 56,103 | Capital projects | 339,394 |

| 259,698 | Other services | 268,929 |

| 0 | Contingencies | 0 |

| 851,619 | 1,045,034 | |

| 135,075 | Balance Transfer | -58,340 |

| 986,694 | TOTAL | 986,694 |

| Net expenditure (£) | Net expenditure (£) | |

| 2021/22 | Frampton Cotterell Parish Council | 2022/23 |

| 53,816 | Recreation | 69,251 |

| 0 | Capital projects | 30,000 |

| 335,483 | Other services | 283,330 |

| 0 | Contingencies | 0 |

| 389,299 | 382,581 | |

| 44,930 | Balance Transfer | 27,881 |

| 344,369 | TOTAL | 354,700 |

| Net expenditure (£) | Net expenditure (£) | |

| 2021/22 | Oldland Parish Council | 2022/23 |

| 95,423 | Recreation | 102,901 |

| 0 | Capital projects | 0 |

| 66,365 | Other services | 80,016 |

| 0 | Contingencies | 1,800 |

| 161,788 | 184,717 | |

| 0 | Balance Transfer | 0 |

| 161,788 | TOTAL | 184,717 |

| Net expenditure (£) | Net expenditure (£) | |

| 2021/22 | Patchway Town Council | 2022/23 |

| 85,625 | Recreation | 100,160 |

| 199,814 | Capital projects | 431,757 |

| 445,216 | Other services | 284,726 |

| 0 | Contingencies | 0 |

| 730,655 | 816,643 | |

| 0 | Balance Transfer | 0 |

| 730,655 | TOTAL | 816,643 |

| Net expenditure (£) | Net expenditure (£) | |

| 2021/22 | Sodbury Town Council | 2022/23 |

| 86,770 | Recreation | 89,770 |

| 0 | Capital projects | 0 |

| 202,618 | Other services | 208,025 |

| 0 | Contingencies | 0 |

| 289,388 | 297,795 | |

| -15,336 | Balance Transfer | -15,381 |

| 274,052 | TOTAL | 282,414 |

| Net expenditure (£) | Net expenditure (£) | |

| 2021/22 | Stoke Gifford Parish Council | 2022/23 |

| 238,100 | Recreation | 185,240 |

| 37,000 | Capital projects | 67,050 |

| 232,000 | Other services | 280,825 |

| 0 | Contingencies | 0 |

| 507,100 | 533,115 | |

| -62,100 | Balance Transfer | 0 |

| 445,000 | TOTAL | 533,115 |

| Net expenditure (£) | Net expenditure (£) | |

| 2021/22 | Thornbury Council | 2022/23 |

| 494,094 | Recreation | 480,511 |

| 0 | Capital projects | 124,000 |

| 258,180 | Other services | 439,587 |

| 121,536 | Contingencies | 59,435 |

| 873,810 | 1,103,533 | |

| -89,830 | Balance Transfer | -268,220 |

| 783,980 | TOTAL | 835,313 |

| Net expenditure (£) | Net expenditure (£) | |

| 2021/22 | Winterbourne Parish Council | 2022/23 |

| 76,350 | Recreation | 76,232 |

| 0 | Capital projects | 0 |

| 109,000 | Other services | 103,868 |

| 0 | Contingencies | 0 |

| 185,350 | 180,100 | |

| 0 | Balance Transfer | 5,250 |

| 185,350 | TOTAL | 185,350 |

| Net expenditure (£) | Net expenditure (£) | |

| 2021/22 | Yate Town Council | 2022/23 |

| 892,885 | Recreation | 960,500 |

| 95,252 | Capital projects | 101,200 |

| 656,313 | Other services | 659,376 |

| -136,394 | Contingencies | -102,570 |

| 1,508,056 | 1,618,506 | |

| -109,554 | Balance Transfer | -78,512 |

| 1,398,502 | TOTAL | 1,539,994 |

Download the above tables as a csv file.

Other levies on the council

The following levies and precepts have been received by South Gloucestershire Council:

| 2021/ 2022 £ | 2022/ 2023 £ | |

| Land Drainage – Lower Severn (2005) Internal Drainage Board | £330,795 | £361,488 |

| Wessex Regional Flood and Coastal Committee | £365,171 | £375,327 |

| Avon Fire Authority | £7,493,503 | £7,806,147 |

| Avon and Somerset Police and Crime Commissioner | £23,648,213 | £25,155,922 |

Download the above table as a csv file.

Details of the land drainage and flood defence levies are set out below and reflect current funding arrangements.

| Wessex RFCC 2021/22 | Wessex RFCC 2022/23 | Lower Severn | Lower Severn | |

| Drainage Board 2021/22 | Drainage Board 2022/23 | |||

| £000 | £000 | £000 | £000 | |

| Gross expenditure | 40,221 | 61,588 | 2,242 | 1,952 |

| Net expenditure | 4,894 | 3,681 | 1,863 | 1,563 |

| Levy requirement | 3,857 | 3,494 | 1,357 | 1,485 |

| Changes in levies requirement due to: | ||||

| Inflation | N/A | N/A | 37 | 35 |

| Changes in quality/quantity of service | N/A | N/A | 25 | 25 |

| Fees and Charges | N/A | N/A | 4 | 5 |

| Other | N/A | N/A | 398 | -365 |

Download the above table as a csv file.

| Wessex RFCC 2021/22 | Wessex RFCC 2022/23 | Lower Severn | Lower Severn | |

| Drainage Board 2021/22 | Drainage Board 2022/23 | |||

| £000 | £000 | £000 | £000 | |

| Change in net expenditure | 33,870 | 21,367 | 464 | -300 |

| Transfer from (-) or to (+) balances | -408 | 428 | ||

| Change in levy requirement | 75 | -363 | 56 | 128 |

| Council Tax – Band D Properties | 1,036 | 1,036 |

Download the above table as a csv file.

Contact us

If you need any further advice or you are unable to print this document and require a hard copy you can:

- call 01454 868003

- email counciltax@southglos.gov.uk