Community Infrastructure Levy (CIL)

Introduced in 2010, the Community Infrastructure Levy (CIL) is a tool for local councils to help raise funds from developers to deliver infrastructure such as new schools, open space or public transport.

CIL is charged for certain types of development in the area and commenced on 1 August 2015.

You can read our frequently asked questions about the CIL to find out more.

Infrastructure Funding Statement

CIL regulations in September 2019 introduced a requirement for councils to publish annually an Infrastructure Funding Statement (IFS) on the use of both CIL and Section 106 monies. Published IFS documents are available below:

- 2024-25 Infrastructure Funding Statement

- 2023-24 Infrastructure Funding Statement

- 2022-23 Infrastructure Funding Statement

- 2021-22 Infrastructure Funding Statement

- 2020-21 Infrastructure Funding Statement

- 2019-20 Infrastructure Funding Statement

Updated CIL regulations (September 2019)

CIL regulations were updated in September 2019. The key changes were:

- removal of the restrictions on section 106 to fund infrastructure

- removal of the Regulation 123 Infrastructure List and replacement with an annual Infrastructure Funding Statement (IFS)

As a result of these changes there is now increased flexibility for us to collect additional section 106 planning obligations, as well as the CIL. Section 106 obligations however must meet the tests set out in Regulation 122 which are that they are necessary, reasonable and directly related to the development.

Providing that these tests are met and the council is satisfied that there is no double recovery with the CIL receipts that would be due from that development, the Council will use planning obligations to provide additional funding towards infrastructure needs.

If our approach gives rise to genuine viability issues, the applicant has the opportunity to demonstrate that in accordance with paragraph 57 of the National Planning Policy Framework (NPPF).

The council will therefore be applying the changes for any relevant major applications (see below) that were received or substantial amended after 1 September 2019 and planning obligations remain yet to be substantively resolved.

To help ease the implementation, the new enhanced section 106 procedures will initially be applied as follows:

- urban areas – 30 dwellings or more

- rural areas – 10 dwellings or more

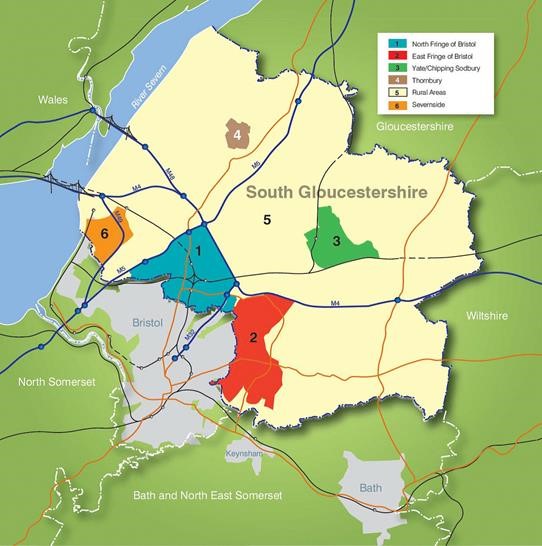

The definition of ‘rural areas’ is proposed to be based on the Core Strategy, figure 3a (page 112) and subsequent ‘part II’ policies.

Rural areas will be defined as all areas with the exception of those defined as urban below:

Urban areas

- North Fringe (Filton, Patchway, Bradley Stoke, Stoke Gifford, Harry Stoke and Frenchay).

- East Fringe (Downend, Emersons Green, Mangotsfield, Staple Hill, Soundwell, Kingswood, Warmley, Cadbury Heath, Oldland Common, Longwell Green and Hanham)

- Yate and Chipping Sodbury

- Thornbury and Severnside

Including any proposed development adjacent to the settlements above, such that any reasonable person would conclude that the development will form an extension of the existing settlement edge.

Rural areas

Elsewhere in South Gloucestershire (covered by area 5 as shown in the map above).

CIL/S106 SPD

To take account of the amended regulations, we have updated our CIL and Section 106 Planning Obligations Guide Supplementary Planning Document (SPD).

CIL Review

It is important to note that the change in CIL regulations (and subsequently the refreshing of the SPD) does not mean that the CIL Charging Schedule for South Gloucestershire changes. The review of the CIL Charging Schedule is currently on hold due to the Covid-19 pandemic, to allow for the economy and house building industry to re-adjust.

Our process to adopt CIL

We adopted our CIL charges as follows:

- December 2012 – we consulted on ‘preliminary draft charges’

- May 2014 – we consulted on ‘draft charges’

- December 2014 – our charges were subjected to an Independent Examination

- 18 March 2015 – we formally adopted the CIL charges at Full Council

- 1 April 2020 – we formally adopted the Enforcement and surcharging policy

- 11 March 2021 – we formally adopted a refresh to our CIL and S106 Guide SPD

Types of development liable for CIL

The following are liable for Community Infrastructure Levy (CIL):

- development comprising 100m² or more of new build floorspace

- development of one or more dwellings (a house, flat, or other place of residence)

- the conversion of a building that is no longer in lawful use (not used for at least 6 months within the last 3 years)

If you submit a planning application which includes any of the above, you need to supply further information for us to calculate the CIL liability.

Where you have an undecided planning application, we may ask you for additional CIL information as liability occurs at the decision stage, not when the application was submitted.

In some limited cases, development which falls into the above categories will not require planning permission, but may still be liable for CIL. This is known as chargeable development and you need to tell us about it.

Application forms

Before you start you will need to download and save any form(s) before completing them using Adobe Reader desktop software/mobile app or full Adobe Acrobat software.

All CIL forms are available from the planning portal, however the following are most commonly used.

Form 0: CIL questions or additional informationThis form must be submitted with all planning applications where the floor space created by the development is 100 square metres or more or for the creation of a dwelling(s). Further guidance is available for completing this form.

Form 1: assumption of liabilityOnce a decision notice is issued, a liability notice will be sent to the applicant/agent with the amount liable. This form is required to confirm who will be liable to make the CIL payment. It is also required if the customer wishes to claim relief, as relief can only be claimed once the person has assumed liability to pay CIL.

Form 2: claiming exemption or reliefThis form is used when claiming either charitable or social housing relief. It needs to be received and a decision on the granting of relief issued prior to any work commencing on site. If work commences prior to a decision then relief will not be allowed.

Form 4: transfer of assumed liabilityThis form is used if, at any stage prior to the start of the development, the person who has assumed liability for CIL wishes to transfer liability to another person. An example might be that the development is being sold.

Form 6: commencement noticeThis form must be submitted by the person liable for CIL at least 1 day prior to the development commencing. We recommend emailing the completed form to ensure it is received. The implications of not submitting this form on time would result in any relief being revoked and a possible surcharge.

Form 7: self build relief exemption claim form (part 1)This form can be submitted along with the application if the applicant wishes to claim self-build relief, or should be submitted prior to any work commencing on site. A decision on relief must be granted and a commencement notice (Form 6) submitted to the CIL team at least one day before commencement, otherwise relief will be revoked and the liable person will be required to pay the full amount of CIL.

Form 7: self build relief exemption claim form (part 2)This form must be submitted within 6 months of completion of the self build residential building, together with the evidence detailed in the form. Failure to submit this form will result in relief being revoked and the liable person being required to pay the full amount of CIL.

Charges and charging zones

Our charges and charging zones for CIL are as follows:

- charging schedule

- charging zones combined

- prime locations

- prime locations zoomed

- CIL payments policy

More information about the Community Infrastructure Levy and how it works can be found in our supplementary planning guide to CIL and Section 106 planning obligations, on the planning portal and at GOV.UK . You can also view a summary of the key steps for the CIL process.

Exemptions and reliefs

Certain developments may quality for a CIL exemption or relief. It is important to follow the correct process and claims procedure or you may become liable for the full levy charge. Further information and forms are available in our supplementary planning guide and on the planning portal.

Appeals

You may appeal if you disagree with a decision relating to the calculation and enforcement of CIL.