Page contents

- Introduction

- Paying your council tax or business rates

- Your council tax

- Council tax valuation bands

- Housing benefit and council tax reduction

- Business rates or non-domestic rates

- State aid

- The council’s budget

- Council services and how they are funded

- Why has the budget changed?

- Why has the council tax income changed?

- Capital investment

- Council tax to be collected and payments due

- Town and parish councils spending more than £140,000

- Other levies and precepts on the council

Introduction

‘Where your money goes’ outlines important information about your council tax and business rates and how your money is used to deliver services in South Gloucestershire for the benefit of all residents.

South Gloucestershire Council will invest almost £251 million in services in the 2021/22 financial year. We are pleased to have put forward and agreed a balanced budget, which will continue to invest in and deliver the services our communities have told us are important to them.

At the same time, we remain committed to delivering the best possible value for money, while also taking action to respond to the climate emergency and improve our local environment, which is an investment in all our futures.

I am extremely proud that we have been able to increase investment in some key areas this year. This includes schools, where we continue to work hard to deliver our number one priority, which is to drive up educational standards for all.

This is just part of our focus on the future, which is why we are also taking steps to play our role in combating climate change as well as cleaning up our communities and investing in our high streets.

Paying your council tax or business rates

There are several ways to pay your council tax bill:

- online payment on the first of each month

- cheque on the first of each month (made payable to South Gloucestershire Council)

- automated phone payments on the first of each month 0345 245 0682

- Payzone outlets on the first of each month

- Direct Debit payment on: 4, 12, 20 or 25 of each month for council tax

Business rates are due on the 8 or 20 of each month.

Council tax reduction and housing benefit enquiries

Council tax reduction is a local scheme and exists to help those on a low income to get help to pay their council tax, so apply today if you need this help.

If you need help with council tax reduction or housing benefit you can call 01454 868002.

Council staff at our one stop shops will also be happy to help you with your council tax.

Setting up a direct debit to pay your council tax or business rates

Direct debit is the easiest way to pay your council tax or business rates. This is taken in 10 monthly instalments (you can ask for this to be taken in 12 monthly instalments).

You will receive a mandate with your bill that you can fill out and return to use.

We can also set up your direct debit over the phone on:

- Council Tax: 01454 868003

- Business Rates: 01454 867700

You must have your bank details ready when you call.

You can also:

- write to South Gloucestershire Council, Department for Resources and Business Change, Revenues Services, PO Box 1953, Bristol BS37 0DE

- email counciltax@southglos.gov.uk or businessrates@southglos.gov.uk

Other ways to pay

You can find other ways to pay on the back of your bill.

If you do not pay by direct debit the payment must be on your account by the first of each month.

Post Offices do not accept payment cards. You must use the bar code on your bill to make a payment.

If you do not pay on time action can be taken against you and costs added to your account.

Viewing your details online

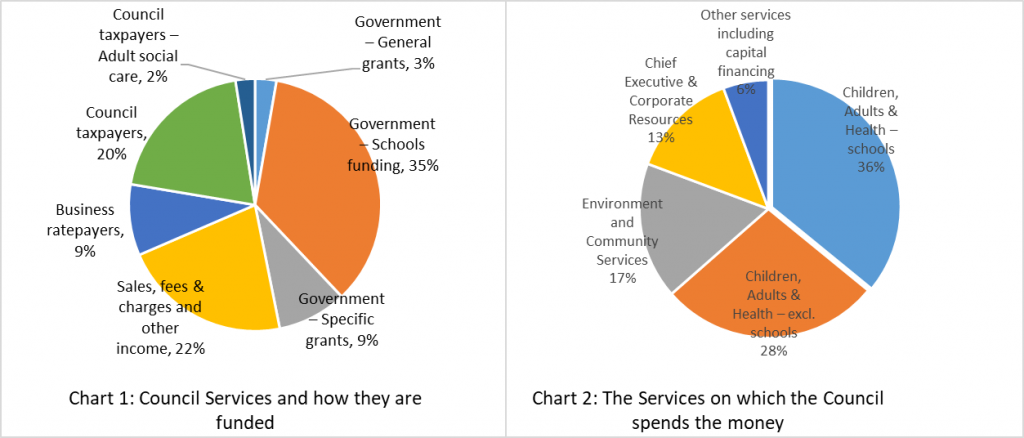

You will need your reference key and billing number from your latest bill to view your details online. These can be found on the front of your bill.

You will be able to view account details (including payments made), set up or amend direct debits, ask for an e-bill rather than a printed copy and update your contact details.

To set this up visit our council tax or business rates page.

Electronic billing

You can now have your council tax bill or rate demand notice sent by email.

This can be arranged through your online account or by contacting us:

- council tax team 01454 868003 or counciltax@southglos.gov.uk

- business rates team 01454 867700 or businessrates@southglos.gov.uk

Exemptions

Some properties are exempt from council tax, these include properties that:

- are occupied by students

- have people under the age of 18 years living in them

- have people who are severely mentally impaired living in them

- are an annexe occupied by a dependent relative

Empty properties exemptions

With effect from 1 April 2013, new legislation introduced by the government abolished the exemption that was available for up to 12 months in respect of an empty property which requires or is undergoing major structural alteration or repair (Class A).

The exemption that was available for up to 6 months after a dwelling becomes unoccupied and unfurnished (Class C) was also abolished.

Deciding whether these exemptions should be replaced by a discount is the responsibility of the elected members of the local authority.

The elected members of this authority decided that no discount is to be given for empty properties. With effect from 1 April 2013, empty properties attract a full charge.

1 April 2020

1 April 2021

From this date properties that have been unoccupied and unfurnished for 10 years or more will incur an additional premium of 300%, making a total of a 400% charge.

Properties that have been empty for 5 to 10 years will still have the same 200% premium, so the 300% charge remains the same.

Support for care leavers

Since 1 April 2018, the council has supported care leavers aged between 18 and 25 under their corporate parenting duties by helping them pay their statutory council tax.

From 1 April 2019, care leavers are exempt from paying council tax.

For more details call 01454 868418 or visit www.usincare.org.uk

Discount eligibility

Council tax is based on two people living in a property. If a person lives alone their council tax can be reduced by 25%.

A discount may also apply if a resident meets certain criteria including being:

- a full-time student

- in prison

- a person who is severely mentally impaired

- a care worker (depending on certain conditions)

- an 18-19 year old school leaver

- a religious community member

- a member of visiting forces

- a long-term hospital patient or nursing home resident who will not be returning home

An annexe (or similar self-contained part of a home) which is occupied as part of the main home or is the main home of a relative of the council taxpayer of the main home can qualify for 50% discount.

Your council tax

The South Gloucestershire Council element of the council tax for a B and D property for 2021/22 is £1,620.39, an increase of £77.02.

With precepts added from the Police and Crime Commissioner, Avon Fire Authority and all 47 parishes, the average 2021/22 total council tax for a Band D property is £2,022.41.

Precepts (payment for essential services)

Your council tax bill also collects precepts for the police, fire services, town and parish councils, and special expenses.

Emergency services

In 2021/22 Avon and Somerset Police and Crime Commissioner charges have increased by 5.88% (or £13.39 on an average B and D property).

Avon Fire Authority charges have increased by 1.99%.

You can read more about these charges:

Town and parish councils

There are 47 town and parish councils in South Gloucestershire, not all areas have one.

Town and parish councils set their budgets independently, and while the average increase for 2021/22 is 1.56%, the charges range from about -15.8% to about +16.7%.

Special expenses

The cost of the council’s services is spread mainly uniformly over the authority’s area.

In some areas, the town or parish council may provide services which are the responsibility of South Gloucestershire Council in others. These are called special expenses.

Special expenses are only charged to the areas which directly benefit from them. They vary across the 47 parished and the unparished areas.

Your council tax bill explained

Council tax valuation bands

All properties are put into one of eight valuation bands.

Council tax bands are issued by the listing officer at the Valuation Office Agency (VOA), which is part of HM Revenue and Customs.

A full list of bands is available on the Valuation Office Agency (VOA) website.

All council tax valuations are based on the price a property would have been sold for on 1 April 1991.

There is one bill per household.

Valuation bands

A – up to and including £40,000

B – £40,001 to £52,000

C – £52,001 to £68,000

D – £68,001 to £88,000

E – £88,001 to £120,000

F – £120,001 to £160,000

G – £160,001 to £320,000

H – more than £320,000

To get in touch with the Valuation Office Agency you can:

- visit the Valuation Office Agency (VOA) website to contact them online

- phone 03000 501 501

- write to the Valuation Office Agency, Durham Customer Service Centre, Wycliffe House, Green Lane, Durham, DH1 3UW

Answers to your questions

Can I appeal against my property’s council tax valuation band?

The Valuation Office Agency (VOA) values domestic properties for council tax. This valuation is used to set your council tax band. You might need to contact the VOA if you think your council tax band is wrong.

GOV.UK has more information about when you can challenge your council tax band and what you need to do.

If you challenge your band, you must continue to pay council tax at your current band until your appeal is decided.

Can I appeal against my property’s business rates valuation?

The Valuation Office Agency (VOA) values all business properties for business rates. The valuation is based on information the VOA holds about your property.

You can find and check your business rates valuation on GOV.UK.

The VOA is contacting businesses to request rental information to support the next revaluation of business rates in England and Wales – Revaluation 2023.

If you receive a request complete and submit your up-to-date details. It is important to provide this information to ensure business rates are fair and accurate.

GOV.UK has more information: Providing rental information for Revaluation 2023

Local discounts (council tax)

The government gave local authorities the power to introduce local discounts in 2003. These are discounts that are relevant to people in the local area.

In making these regulations the government stated that the onus of paying for these discounts would fall to the local authority. These would then be charged to other council tax payers.

After considering our options we decided not to award any local discounts on a general basis at the present time.

This does not mean that individuals cannot apply for a discount based on their circumstances. We will consider any applications.

To apply write to South Gloucestershire Council, Department for Resources and Business Change, PO Box 1953, Bristol BS37 0DE to apply.

Second home discount

From 1 April 2013 the elected members decided to remove the 10% discount for properties classed as ‘second homes’.

All properties that are second homes will now pay a full charge, except for those provided by an employer.

Housing benefit and council tax reduction

People with disabilities

You may be entitled to a reduced council tax bill if someone in your home needs an extra room or space to meet their special needs because of a disability.

Your bill may be reduced by one band if you are in band B to H. If your property is in band A, you will be entitled to a reduction that is the same as one-ninth of the band D charge.

These reductions mean that people do not pay more tax because of space needed due to someone in the house having a disability.

More information on reductions can be found in our council tax section.

If you think you may be entitled to a discount call 01454 868003.

Appeals

There are two areas for appeal.

Against the valuation band (area 1)

These appeals should be made in writing to the Council Tax section, at South Gloucestershire Council.

You still need to pay your council tax whilst waiting for the appeal decision.

Against your council tax charge (area 2)

You can appeal if you think you are not liable to pay council tax because:

- you are not the owner or the resident

- your property is exempt

- you think there has been a mistake in the way your bill has been calculated

Getting help to pay your council tax

You may be able to get some financial help if you are:

- on a low income

- receiving retirement pension

- finding it difficult to pay your rent or council tax

The amount you can get depends on:

- your weekly income

- what you have in your bank or building society

- the number and age of the people in your household

If you have savings of more than £16,000 you are not eligible for housing benefit unless you qualify for guaranteed pension credit.

To apply for housing benefit and/or council tax reduction you must complete an application form which is available online.

You can also visit our one stop shops or call 01454 868002.

Reporting changes in your circumstances

Important

It is your responsibility to tell us immediately about any changes that may affect the amount of housing benefit, council tax exemption, discount, or reduction you get.

You are committing an offence if you deliberately fail to tell us about a change in your circumstances.

Business rates or non-domestic rates

Covid-19 impact on business rates and support schemes

Covid-19 has had a huge impact on businesses.

At South Gloucestershire Council we have worked hard to make sure that businesses affected by the pandemic have received the support they are eligible for.

For the latest information on coronavirus support please visit our Covid-19 page.

Business rates (or non-domestic rates) are taxes paid on non domestic properties to help towards the cost of local council services.

Business rates retention arrangements

Introduced from 1 April 2013 these arrangements allow authorities keep a proportion of the local business rates.

This gives local authorities a direct financial incentive to work with local businesses to create a thriving environment for growth.

This helps pay for the services provided by the local authority in your area.

GOV.UK has further information about the business rates system, including transitional and other reliefs.

Rateable value

Apart from properties that are exempt from business rates, each non-domestic property has a rateable value.

This is set by the valuation officers the Valuation Office Agency (an agency of Her Majesty’s Revenue and Customs).

You can find and check your business rates valuation on GOV.UK.

The front of your bill shows a rateable value for your property. This broadly represents the yearly rent the property could have been let for on the open market on a particular date.

On 1 April 2008, a revaluation was set that came into effect on 1 April 2010. On 1 April 2015, a revaluation was set that came into effect on 1 April 2017.

The valuation officer may change the value of a property if circumstances change.

You (and certain others who have an interest in the property) can appeal against the value if you think it is wrong.

Your billing authority can only backdate any business rates rebate to the date from which any change to the list is made effective.

The Valuation Office Agency (VOA) will continue to fulfil its legal obligations to change rating assessments if they have new information that shows the valuation is wrong.

You can check and challenge your business rates valuation on GOV.UK or contact you local valuation office.

National non-domestic rating multiplier

The local authority works out the business rates bill by multiplying the rateable value of the property by the appropriate multiplier.

There are two multipliers:

- standard non-domestic rating multiplier

- small business non-domestic rating multiplier

The standard non-domestic rating multiplier is higher to pay for small business rate relief (except for London).

The government sets the multipliers for each financial year for the whole of England by using a formulae set by legislation.

You can find the current multipliers on the front of your bill.

Business rates instalments

Business rate bill payments are automatically set on a 10 month cycle from April to January.

The government legislated in 2014/15 that businesses can ask for their business rate bill payments to be taken over 12 months.

You can change your instalment plan to 12 months by contacting the business rates team on 01454 867700 or email businessrates@southglos.gov.uk.

Unoccupied property rating

Business rates are not payable in the first 3 months that a property is empty. This is extended to 6 months for certain industrial properties.

After this time rates are payable in full unless the unoccupied property rate has been reduced by the government by order.

In most cases the unoccupied property rate is nil for properties owned by charities and community amateur sports clubs. There are also other exemptions from the unoccupied property rate.

The front of your bill will detail any periods that you were exempt from paying rates.

Full details on exemptions can found on our business rates page.

Small Business Rate Relief

Small business rate relief was introduced on 1 April 2017.

This means that if you occupy a property that has a rateable value of less than £15,000, you may be able to get a discount on your business rates.

The relief is applied as follows:

- properties with a rateable value up to and including £12,000 can get up to 100% relief

- properties with a rateable value between £12,001 and £14,999 can receive a tapered relief

The relief is available to ratepayers with either:

- one property

- one main property and other additional properties that have individual rateable values of less than £2,899 (if the total rateable value of all properties is less than £20,000)

Change of circumstances

You must tell the business rates team if you are receiving small business rates relief and any of the following happens:

- you start to occupy an additional property

- an increase in the rateable value of a property you occupy that is not in our local authority

Important

You must tell us of a change in circumstances within 4 weeks of it taking place.

You can find more information about this relief (including what the scheme was like before 1 April 2017) on our business rates page.

Charity and community amateur sports club relief

Charities and registered community amateur sports clubs are entitled to 80% relief if they occupy the property themselves and it is mainly used for their charitable or sporting purpose

The local authority has discretion to give further relief on the remaining bill. Contact the business rates team or visit our business rates page.

Retail relief 2020/21 and 2021/22

The retail relief for 2020/21 was changed due to the Covid-19 pandemic.

100% relief was awarded under the expanded retail relief scheme.

Eligible businesses are:

- shops

- restaurants, cafés, bars or pubs

- cinemas or live music venues

- assembly or leisure properties (for example, a sports club, a gym or a spa)

- hospitality properties (for example, a hotel, a guest house or self-catering accommodation)

On 3 March, the government announced an extension to the 100% retail, hospitality and leisure rate relief to the end of June 2021.

There will be a new 66% relief for the same premises from July 2021 to March 2022. This will be capped at £2m per business for properties which were required to close from 5 January 2021 and £105k per business for other eligible properties.

These reliefs will also apply to childcare nurseries.

For more information visit our businesses and self employed page.

If you have not received a revised rate demand notice by the end of April but think you are eligible or that by receiving this award you will be exceeding State Aid De Minimis Regulations, contact the business rates team to review your business rates account.

Local discounts (business rates)

Local authorities have a general power to grant discretionary local discounts. Contact the business rates team or visit our business rates page.

Business support grants

During the pandemic central government issued local authorities with funding and guidance to share funds to support businesses during the restrictions of lockdown and tiers 1, 2 and 3.

Most of these funding streams will close by 31 March 2021 and has been replace by Business Restart Grants.

State aid

The award of such discounts is considered to amount to state aid. However it will be state aid compliant where it is provided in accordance with the De Minimis Regulations EC 1407/2013.

The De Minimis Regulations allow an undertaking to receive up to €200,000 ‘de minimis’ aid over a rolling three year period.

Important

If you are receiving, or have received, any ‘de minimis’ aid granted during the current or two previous financial years (from any source), you should inform the local authority immediately with details of the aid received.

Hardship Relief

The local authority has discretion to give hardship relief in specific circumstances. Contact the business rates team or visit our business rates page.

Transitional relief

At a revaluation (1 April 2017), some ratepayers will see reductions or no change in their bill and others will see increases.

Transitional relief schemes are introduced at each revaluation to help those facing increases. This relief has been funded by limiting the reduction in bills for those whose revaluation has been favourable.

Transitional relief is applied automatically.

GOV.UK has more information about transitional arrangements and other reliefs.

E billing

Rate demand notices can now be sent by email.

If you would like to have your bill safely and securely emailed to you contact the Business Rates team on 01454 867700 or email businessrates@southglos.gov.uk.

Rating advisers

Appeals against rateable values can be made free of charge. Ratepayers do not have to be represented.

Ratepayers who would like to be represented can employ a rating adviser. Before you employ a rating adviser, check that they have the necessary knowledge and expertise. They also need appropriate indemnity insurance

The Royal Institution of Chartered Surveyors and the Institute of Revenues, Rating and Valuation are qualified and regulated by rules of professional conduct designed to protect the public from misconduct.

Information supplied with demand notices

Information relating to the relevant and previous financial years in regard to the gross expenditure of the local authority can be viewed in the council’s budget section.

Business rates team

Phone: 01454 867700

Payment phone line: 0345 245 0682

Email: businessrates@southglos.gov.uk

Website: visit our business rate section

The council’s budget

The council increased its share of the council tax by 1.99% in 2020/21 for the general council tax precept with a 2% increase for adult social care.

For 2021/22, the council is increasing its share of the general council tax by 1.99% and 3% for adult social care, in line with government limits.

The 2021/22 Budget also includes updated details of the Council Transformation and Savings Programmes.

Since 2014/15 and up to the end of 2020/21 the council will have reduced annual spending by nearly £57.9m through a range of efficiency measures.

The current savings programme is planned to deliver a further £7.1m by 2024/25, leaving a core funding deficit thereafter of circa £16.3m per annum.

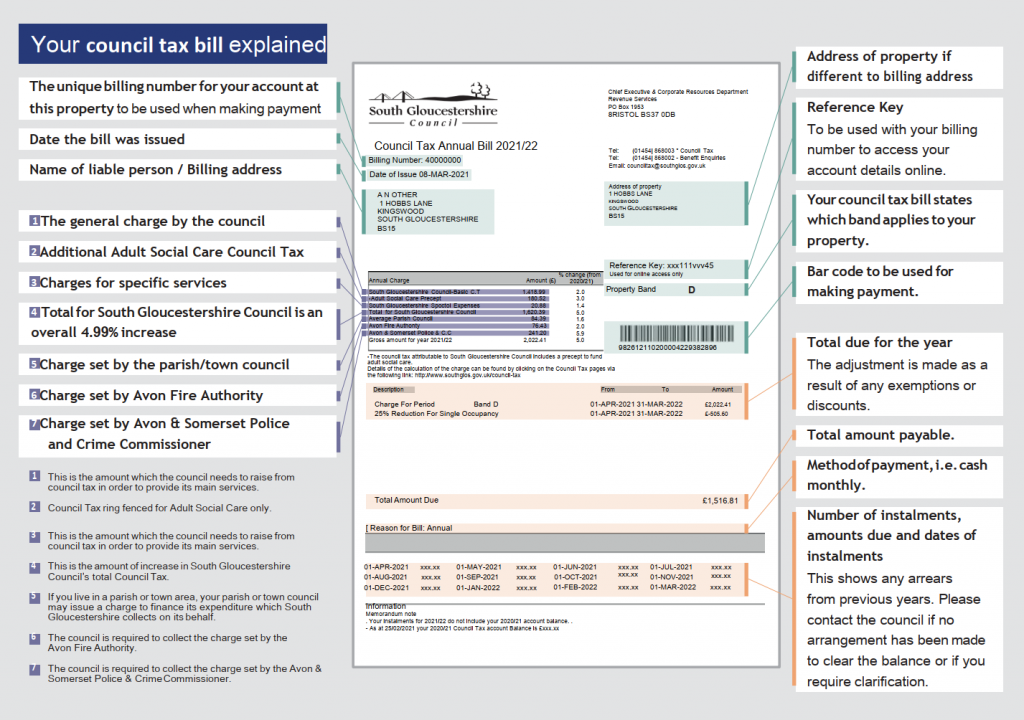

The first pie chart shows where the council will obtain its funding for 2021/22:

- 22% from council tax payers (of which 2% is ring fenced for adult social)

- 9% from business rate payers

- 47% from government

- 22% from sales, rents, and fees and charges

The second pie chart shows the services on which the council spends money:

- 36% on schools

- 28% on services for young people other than at school, and for the elderly and those with disabilities and public health

- 17% on transport, environment, and community services

- 6% for capital financing

- 13% for other services

The council has consulted residents on its budget proposals. 1,393 responses were received. Of those consulted 36% thought the council offered good value for money.

Most thought the council was right to focus on savings by:

- being more efficient in its use of assets such as land and buildings

- changing working practices to make better use of technology

- more efficient ways of working

- working in partnership and sharing services with other councils and public sector agencies

All the council’s core activities were supported by most of the respondents. The highest levels of support were for:

- education

- health and wellbeing

- safeguarding vulnerable children and adults

- protecting the environment

The council has recognised these views in setting its budget.

Plans for the next 10 years

The council has looked at the next 10 years’ plans. The government had previously announced its intention to change the way all councils are to be financed through the business rates retention system during 2021/22.

This has been delayed for another year as result of the pandemic and is now expected to come into effect from 2022/23.

Significant work and engagement with local government has already been undertaken by central government and will continue over the next financial year. Alongside some other devolution areas, the councils in the West of England Combined Authority area (which includes this council) previously entered into a pilot for 100% rates retention from 1 April 2018 and the council continues to benefit from this in 2021/22.

The council expects that further investment will be needed in services for the over 65s and for vulnerable young people over the next few years.

In order to achieve a balanced budget in the medium term, the council needs to achieve the savings identified in its budget proposals amounting to an additional:

- £4.3m in 2021/22

- £2.2m in 2022/23

- £0.6m in 2023/24

In addition to this, it retains a base budget funding gap of c. £15.6m rising to £16.3m in 2024/25 for which further savings will need to be identified.

More detailed savings proposals will be made to Cabinet in the autumn and any decisions impacting on staff or residents will be subject to the appropriate consultation.

Council services and how they are funded

The following tables show the council’s revenue budget for last year and the current year plus indicative budgets for the next three years.

They also show the causes of the change in net spending and the capital investment being made by the council in its buildings, roads and other facilities.

| 2020/21 | 2020/21 | 2020/21 | 2020/21 | 2021/22 | 2021/22 | 2021/22 | 2021/22 | 2021/22 | 2022/23 | 2022/23 | 2022/23 | 2023/24 | 2023/24 | 2023/24 | 2024/25 | 2024/25 | 2024/25 |

| Gross | Net | Gross | Use of | Net | Gross | Net | Gross | Net | Gross | Net | |||||||

| Exp | Income | Exp | Exp | Income | Reserves | Exp | Exp | Income | Exp | Exp | Income | Exp | Exp | Income | Exp | ||

| (£m) | (£m) | (£m) | (£m) | (£m) | (£m) | (£m) | (£m) | (£m) | (£m) | (£m) | (£m) | (£m) | (£m) | (£m) | (£m) | ||

| SERVICES | |||||||||||||||||

| 234.1 | -234.1 | 0.0 | Children, Adults & Health – schools | 36% | 256.4 | -250.5 | -5.9 | 0.0 | 256.4 | -256.4 | 0.0 | 256.4 | -256.4 | 0.0 | 256.4 | -256.4 | 0.0 |

| 189.7 | -47.0 | 142.7 | Children, Adults & Health – excl. schools | 28% | 197.3 | -43.9 | -4.3 | 149.1 | 197.2 | -47.2 | 150.0 | 200.6 | -47.4 | 153.2 | 204.8 | -47.5 | 157.3 |

| 94.8 | -52.5 | 42.3 | Environment and Community Services | 17% | 122.5 | -74.0 | -6.4 | 42.1 | 120.4 | -77.6 | 42.8 | 122.3 | -78.0 | 44.3 | 125.3 | -79.3 | 46.0 |

| 92.1 | -74.1 | 18.0 | Chief Executive & Corporate Resources | 14% | 97.3 | -75.1 | -0.8 | 21.4 | 96.5 | -75.0 | 21.5 | 97.1 | -75.1 | 22.0 | 97.9 | -75.1 | 22.8 |

| 44.5 | -15.5 | 29.0 | Other services including capital financing | 6% | 40.5 | -13.1 | 10.9 | 38.3 | 47.4 | -11.8 | 35.6 | 52.8 | -12.4 | 40.4 | 53.1 | -8.8 | 44.3 |

| 655.1 | -423.2 | 231.9 | Total Expenditure | 100% | 714.0 | -456.6 | -6.5 | 250.9 | 717.9 | -468.0 | 249.9 | 729.2 | -469.3 | 259.9 | 737.5 | -467.1 | 270.4 |

| FUNDING | |||||||||||||||||

| -16.6 | -16.6 | Government – General grants | 3% | -23.0 | -23.0 | -11.4 | -11.4 | -9.7 | -9.7 | -9.4 | -9.4 | ||||||

| -229.7 | -229.7 | Government – Schools funding | 35% | -250.5 | -250.5 | -250.5 | -250.5 | -250.5 | -250.5 | -250.5 | -250.5 | ||||||

| -62.7 | -62.7 | Government – Specific grants | 9% | -63.2 | -63.2 | -63.2 | -63.2 | -63.2 | -63.2 | -63.2 | -63.2 | ||||||

| -133.5 | -133.5 | Sales, fees & charges and other income | 22% | -153.7 | -153.7 | -165.2 | -165.2 | -155.2 | -155.2 | -153.4 | -153.4 | ||||||

| -63.1 | -63.1 | Business ratepayers | 9% | -64.8 | -64.8 | -63.1 | -63.1 | -63.9 | -63.9 | -66.7 | -66.7 | ||||||

| -136.4 | -136.4 | Council taxpayers | 20% | -141.2 | -141.2 | -146.5 | -146.5 | -152.8 | -152.8 | -159.3 | -159.3 | ||||||

| -13.0 | -13.0 | Council taxpayers – Adult social care | 2% | -17.7 | -17.7 | -18.0 | -18.0 | -18.3 | -18.3 | -18.7 | -18.7 | ||||||

| -655.1 | -655.1 | Total Funding | 100% | -714.1 | -714.1 | -717.9 | -717.9 | -713.6 | -713.6 | -721.2 | -721.2 | ||||||

| Forecast (surplus) /Deficit | -0.1 | 0.0 | 15.6 | 16.3 |

Download the above table as a csv file.

Why has the budget changed?

| 2020/21 to 2021/22 | 2021/22 to 2022/23 | 2022/23 to 2023/24 | 2023/24 to 2024/25 | |

| £m | £m | £m | £m | |

| Budget for the previous year | 231.9 | 250.9 | 249.9 | 259.9 |

| Inflation, pay awards, and taxation | 7.6 | 4.2 | 5.4 | 5.8 |

| Pension changes | -0.8 | 0.5 | 0.8 | 0.9 |

| Savings | -4.1 | -1.9 | -0.6 | 0.0 |

| Children’s & Adults Social Care Price and Demand | 1.6 | 2.8 | 0.0 | 3.6 |

| Other | 14.7 | -6.6 | 4.4 | 0.2 |

| Budget for the current year | 250.9 | 249.9 | 259.9 | 270.4 |

Download the above table as a csv file.

Why has the council tax income changed?

| 2020/21 to 2021/22 | 2021/22 to 2022/23 | 2022/23 to 2023/24 | 2023/24 to 2024/25 | |

| £m | £m | £m | £m | |

| Council tax income for the previous year | -149.4 | -158.9 | -164.4 | -171.1 |

| Change in spending | 19.0 | -1.0 | 10.0 | 10.5 |

| Change in government grant | 27.6 | -11.5 | -1.7 | -0.3 |

| Retained business rates | 2.2 | -1.7 | 0.8 | -2.8 |

| Collection fund deficit (-) / surplus | -0.5 | -0.4 | 0.0 | 0.0 |

| Use of balances | -57.8 | 9.1 | -15.8 | -14.3 |

| Council tax income for the year | -158.9 | -164.4 | -171.1 | -178.0 |

Download the above table as a csv file.

Capital investment

| 2021/22 | 2022/23 | 2023/24 | 2024/25 | |

| £m | £m | £m | £m | |

| Children, Adults and Health | 39 | 24 | 7 | 5 |

| Environment and Community Services | 32 | 17 | 15 | 13 |

| Economic Development Fund schemes | 44 | 15 | 4 | 9 |

| Other services and Invest to Save | 38 | 7 | 6 | 2 |

| Total | 153 | 63 | 32 | 29 |

Download the above table as a csv file.

Council tax to be collected and payments due

| 2020/21 | 2020/21 | 2021/22 | 2021/22 | |

| Precept | Payments | Precept | Payments | |

| Band D | Band D | |||

| £ | £ | £ | £ | |

| 149,313,614 | 1,543.37 | South Gloucestershire tax requirement | 158,869,169 | 1,620.39 |

| – 1,993,238 | – 20.6 | Less special expenses reallocated | – 2,047,306 | – 20.88 |

| 147,320,376 | 1,522.77 | 156,821,863 | 1,599.51 | |

| 7,250,070 | 227.81 | Avon Fire Authority | 7,493,503 | 76.43 |

| 22,039,478 | 74.94 | Avon & Somerset Police & Crime Commissioner | 23,648,213 | 241.20 |

Download the above table as a csv file.

Council tax by area (including parish precepts and special expenses)

2020/21 | 2020/21 | 2020/21 | 2021/22 | 2021/22 | 2021/22 | |

| Precept | Special Expenses | Payments Band D | Precept | Special Expenses | Payments Band D | |

| £354,515.00 | £1,716.74 | Total Unparished Areas | £374,006.00 | £1,947.58 | ||

| £4,915.00 | £370.00 | £1,719.94 | Acton Turville | £5,579.00 | £417.00 | £1,954.70 |

| £131,148.00 | £3,394.00 | £1,752.72 | Almondsbury | £148,773.00 | £4,440.00 | £1,984.50 |

| £54,248.00 | £5,383.00 | £1,732.89 | Alveston | £57,425.00 | £6,075.00 | £1,964.82 |

| £4,415.00 | £39.00 | £1,706.77 | Aust | £5,369.00 | £44.00 | £1,940.89 |

| £94,000.00 | £68,794.00 | £1,737.67 | Bitton | £94,000.00 | £75,988.00 | £1,968.46 |

| £795,293.00 | £118,791.00 | £1,819.77 | Bradley Stoke | £811,681.00 | £132,458.00 | £2,053.16 |

| £62,000.00 | £27,789.00 | £1,776.49 | Charfield | £62,000.00 | £29,286.00 | £1,996.18 |

| £4,000.00 | £0.00 | £1,717.47 | Cold Ashton | £4,200.00 | £0.00 | £1,949.18 |

Council tax by area (including parish precepts and special expenses)

2020/21 | 2020/21 | 2020/21 | 2021/22 | 2021/22 | 2021/22 | |

| Precept | Special Expenses | Payments Band D | Precept | Special Expenses | Payments Band D | |

| £20,000.00 | £287.00 | £1,754.10 | Cromhall | £22,330.00 | £325.00 | £1,989.47 |

| £200,294.00 | £104,837.00 | £1,816.65 | Dodington | £280,000.00 | £116,617.00 | £2,084.42 |

| £304,500.00 | £47,982.00 | £1,764.10 | Downend and Bromley Heath | £304,500.00 | £84,267.00 | £2,001.88 |

| £5,000.00 | £0.00 | £1,719.81 | Doynton | £5,250.00 | £0.00 | £1,949.65 |

| £8,000.00 | £670.00 | £1,748.19 | Dyrham & Hinton | £8,200.00 | £756.00 | £1,979.76 |

| £227,732.00 | £100,940.00 | £1,743.56 | Emersons Green | £256,232.00 | £114,828.00 | £1,974.47 |

| £6,553.00 | £553.00 | £1,716.07 | Falfield | £7,580.00 | £625.00 | £1,943.93 |

| £675,000.00 | £24,645.00 | £1,916.92 | Filton | £986,694.00 | £25,303.00 | £2,243.59 |

| £334,274.00 | £25,764.00 | £1,828.06 | Frampton Cotterell | £344,369.00 | £31,023.00 | £2,062.33 |

| £2,595.00 | £0.00 | £1,710.73 | Great Badminton | £2,685.00 | £0.00 | £1,941.91 |

| £53,856.00 | £67,088.00 | £1,746.34 | Hanham | £57,051.00 | £71,615.00 | £1,976.92 |

| £61,043.00 | £53,187.00 | £1,735.96 | Hanham Abbots | £68,940.00 | £60,711.00 | £1,972.39 |

| £22,589.00 | £3,469.00 | £1,736.52 | Hawkesbury | £23,597.00 | £3,916.00 | £1,967.98 |

| £850.00 | £0.00 | £1,702.74 | Hill | £850.00 | £0.00 | £1,933.57 |

| £5,250.00 | £2,277.00 | £1,727.83 | Horton | £4,000.00 | £2,570.00 | £1,952.39 |

| £44,000.00 | £727.00 | £1,763.95 | Iron Acton | £56,313.00 | £820.00 | £2,012.93 |

| £520.00 | £0.00 | £1,696.51 | Little Sodbury | £520.00 | £0.00 | £1,927.00 |

| £62,537.00 | £11,111.00 | £1,789.27 | Marshfield | £65,241.00 | £10,424.00 | £2,019.94 |

| £15,577.00 | £78.00 | £1,730.31 | Oldbury on Severn | £16,757.00 | £88.00 | £1,962.54 |

| £156,236.00 | £158,838.00 | £1,752.44 | Oldland | £161,788.00 | £176,432.00 | £1,986.76 |

| £50,390.00 | £4,124.00 | £1,747.61 | Olveston | £66,506.00 | £4,631.00 | £1,996.71 |

Council tax by area (including parish precepts and special expenses)

2020/21 | 2020/21 | 2020/21 | 2021/22 | 2021/22 | 2021/22 | |

| Precept | Special Expenses | Payments Band D | Precept | Special Expenses | Payments Band D | |

| £600,730.00 | £46,326.00 | £1,875.35 | Patchway | £730,655.00 | £51,765.00 | £2,113.09 |

| £66,274.00 | £25,327.00 | £1,765.73 | Pilning & Severn Beach | £72,066.00 | £37,006.00 | £2,008.86 |

| £69,162.00 | £19,188.00 | £1,784.65 | Pucklechurch | £84,476.00 | £21,520.00 | £2,028.57 |

| £14,000.00 | £1,134.00 | £1,739.43 | Rangeworthy | £12,500.00 | £1,281.00 | £1,961.13 |

| £2,775.00 | £289.00 | £1,723.61 | Rockhampton | £3,180.00 | £325.00 | £1,958.59 |

| £35,000.00 | £88,554.00 | £1,765.10 | Siston | £40,000.00 | £95,514.00 | £2,002.31 |

| £243,317.00 | £41,992.00 | £1,826.76 | Sodbury | £274,052.00 | £43,967.00 | £2,065.93 |

| £385,000.00 | £70,120.00 | £1,771.93 | Stoke Gifford | £445,000.00 | £90,939.00 | £2,008.27 |

| £62,445.00 | £8,438.00 | £1,787.53 | Stoke Lodge and The Common | £58,970.00 | £9,643.00 | £2,013.85 |

| £623,212.00 | £80,066.00 | £1,831.47 | Thornbury | £783,980.00 | £89,923.00 | £2,081.50 |

| £4,176.00 | £384.00 | £1,713.37 | Tormarton | £7,315.00 | £433.00 | £1,961.75 |

| £200.00 | £0.00 | £1,689.98 | Tortworth | £200.00 | £0.00 | £1,920.48 |

| £25,745.00 | £2,801.00 | £1,779.68 | Tytherington | £30,000.00 | £3,161.00 | £2,007.96 |

| £78,654.00 | £6,322.00 | £1,749.14 | Westerleigh | £87,296.00 | £6,679.00 | £1,980.07 |

| £87,000.00 | £2,111.00 | £1,809.95 | Wick & Abson | £82,500.00 | £2,362.00 | £2,030.58 |

| £36,000.00 | £10,706.00 | £1,752.30 | Wickwar | £49,187.00 | £12,115.00 | £1,991.30 |

| £174,750.00 | £28,303.00 | £1,745.77 | Winterbourne | £185,350.00 | £31,956.00 | £1,974.48 |

| £1,175,049.00 | £191,785.00 | £1,880.11 | Yate | £1,398,502.00 | £221,052.00 | £2,128.34 |

The total council tax required by the 47 town and parish councils amounts to £8,273,659.

Download the above tables as a single csv file.

Town and parish councils spending more than £140,000

| Net Expenditure (£) | Net Expenditure (£) | |

| 2020/21 | Almondsbury Parish Council | 2021/22 |

| 123,370 | Recreation | 124,734 |

| 50,000 | Capital Projects | 100,000 |

| 153,950 | Other Services | 162,700 |

| 0 | Contingencies | 0 |

| 327,320 | 387,434 | |

| 0 | Balance Transfer | 0 |

| 327,320 | TOTAL | 387,434 |

| 2020/21 | Bradley Stoke Town Council | 2021/22 |

| 623,492 | Recreation | 589,020 |

| 0 | Capital Projects | 199,500 |

| 1,239,850 | Other Services | 1,102,402 |

| 19,240 | Contingencies | 18,500 |

| 1,882,582 | 1,909,422 | |

| -1,067,043 | Balance Transfer | -1,097,741 |

| 815,539 | TOTAL | 811,681 |

| 2020/21 | Dodington Parish Council | 2021/22 |

| 92,565 | Recreation | 98,500 |

| 0 | Capital Projects | 0 |

| 150,290 | Other Services | 176,600 |

| 0 | Contingencies | 4,900 |

| 242,855 | 280,000 | |

| 0 | Balance Transfer | 0 |

| 242,855 | TOTAL | 280,000 |

| Net Expenditure (£) | Net Expenditure (£) | |

| 2020/21 | Downend & Bromley Heath Parish Council | 2021/22 |

| 573,853 | Recreation | 619,718 |

| 103,702 | Capital Projects | 91,703 |

| 210,443 | Other Services | 199,463 |

| 0 | Contingencies | 0 |

| 887,998 | 910,884 | |

| -583,498 | Balance Transfer | -606,384 |

| 304,500 | TOTAL | 304,500 |

| 2020/21 | Emersons Green Town Council | 2021/22 |

| 70,984 | Recreation | 25,214 |

| 0 | Capital Projects | 0 |

| 145,721 | Other Services | 210,989 |

| 0 | Contingencies | 0 |

| 216,705 | 236,203 | |

| 29,270 | Balance Transfer | 20,029 |

| 245,975 | TOTAL | 256,232 |

| 2020/21 | Filton Town Council | 2021/22 |

| 370,597 | Recreation | 535,818 |

| 41,103 | Capital Projects | 56,103 |

| 263,426 | Other Services | 259,698 |

| 0 | Contingencies | 0 |

| 675,126 | 851,619 | |

| 40,000 | Balance Transfer | 135,075 |

| 715,126 | TOTAL | 986,694 |

| Net Expenditure (£) | Net Expenditure (£) | |

| 2020/21 | Frampton Cotterell Parish Council | 2021/22 |

| 48,778 | Recreation | 53,816 |

| 0 | Capital Projects | 0 |

| 298,524 | Other Services | 335,483 |

| 0 | Contingencies | 0 |

| 347,302 | 389,299 | |

| -6,343 | Balance Transfer | -44,930 |

| 340,959 | TOTAL | 344,369 |

| 2020/21 | Oldland Parish Council | 2021/22 |

| 95,105 | Recreation | 95,423 |

| 0 | Capital Projects | 0 |

| 63,822 | Other Services | 66,365 |

| 3,179 | Contingencies | 0 |

| 162,106 | 161,788 | |

| 0 | Balance Transfer | 0 |

| 162,106 | TOTAL | 161,788 |

| Net Expenditure (£) | Net Expenditure (£) | |

| 2020/21 | Patchway Town Council | 2021/22 |

| 95,460 | Recreation | 85,625 |

| 90,000 | Capital Projects | 199,814 |

| 545,195 | Other Services | 445,216 |

| 0 | Contingencies | 0 |

| 730,655 | 730,655 | |

| 0 | Balance Transfer | 0 |

| 730,655 | TOTAL | 730,655 |

| 2020/21 | Sodbury Town Council | 2021/22 |

| 70,939 | Recreation | 86,770 |

| 0 | Capital Projects | 0 |

| 188,524 | Other Services | 202,618 |

| 0 | Contingencies | 0 |

| 259,463 | 289,388 | |

| 0 | Balance Transfer | 0 |

| 259,463 | TOTAL | 289,388 |

| 2020/21 | Stoke Gifford Parish Council | 2021/22 |

| 96,969 | Recreation | 238,100 |

| 122,301 | Capital Projects | 37,000 |

| 183,730 | Other Services | 232,000 |

| 0 | Contingencies | 0 |

| 403,000 | 507,100 | |

| 0 | Balance Transfer | -5,000 |

| 403,000 | TOTAL | 502,100 |

| Net Expenditure (£) | Net Expenditure (£) | |

| 2020/21 | Thornbury Town Council | 2021/22 |

| 404,646 | Recreation | 494,094 |

| 0 | Capital Projects | 0 |

| 190,346 | Other Services | 258,180 |

| 131,308 | Contingencies | 121,536 |

| 726,300 | 873,810 | |

| -11,000 | Balance Transfer | -89,830 |

| 715,300 | TOTAL | 783,980 |

| 2020/21 | Winterbourne Parish Council | 2021/22 |

| 84,850 | Recreation | 76,350 |

| 0 | Capital Projects | 0 |

| 96,900 | Other Services | 109,000 |

| 0 | Contingencies | 0 |

| 181,750 | 185,350 | |

| 0 | Balance Transfer | 0 |

| 181,750 | TOTAL | 185,350 |

| 2020/21 | Yate Town Council | 2021/22 |

| 826,699 | Recreation | 892,885 |

| 183,251 | Capital Projects | 95,252 |

| 612,160 | Other Services | 656,313 |

| -192,246 | Contingencies | -136,394 |

| 1,429,864 | 1,508,056 | |

| 95,674 | Balance Transfer | -109,554 |

| 1,334,190 | TOTAL | 1,398,502 |

Download the above tables as a single csv file.

Other levies and precepts on the council

The following levies have been received by South Gloucestershire Council:

| 2020/21 | 2021/22 | |

| £ | £ | |

| Land Drainage – Lower Severn (2005) Internal Drainage Board | £317,154 | £330,795 |

| Wessex Regional Flood and Coastal Committee | £352,370 | £365,171 |

| Avon Fire Authority | £7,250,070 | £7,493,503 |

| Avon & Somerset Police & Crime Commissioner | £22,039,478 | £23,648,213 |

Details of the land drainage and flood defence levies are set out below and reflect current funding arrangements. Information on the police and fire authority precepts is also detailed below.

| Wessex RFCC 2020/21 | Wessex RFCC 2021/22 | Lower Severn (2005) | Lower Severn (2005) | |

| Drainage Board 2020/21 | Drainage Board 2021/22 | |||

| £000 | £000 | £000 | £000 | |

| Gross Expenditure | 42,250 | 76,120 | 1,740 | 2,242 |

| Net Expenditure | 6,314 | 4,894 | 1,399 | 1,863 |

| Levy Requirement | 3,782 | 3,857 | 1,301 | 1,357 |

| Changes in levies requirement due to: | ||||

| Inflation | N/A | N/A | 24 | 37 |

| Changes in quality/quantity of service | N/A | N/A | 25 | 25 |

| Fees and Charges | N/A | N/A | 4 | 4 |

| Other | N/A | N/A | 86 | 398 |

| Wessex RFCC 2020/21 | Wessex RFCC 2021/22 | Lower Severn (2005) | Lower Severn (2005) | |

| Drainage Board 2020/21 | Drainage Board 2021/22 | |||

| £000 | £000 | £000 | £000 | |

| Change in net expenditure | 5,728 | 33,870 | 139 | 464 |

| Transfer from (-) or to (+) balances | -97 | -408 | ||

| Change in levy requirement | 111 | 75 | 42 | 56 |

| Council Tax – Band D Properties | 1,038 | 1,036 |

Download the above tables as a single csv file.

If you are unable to print this document and require a hard copy call 01454 868003.